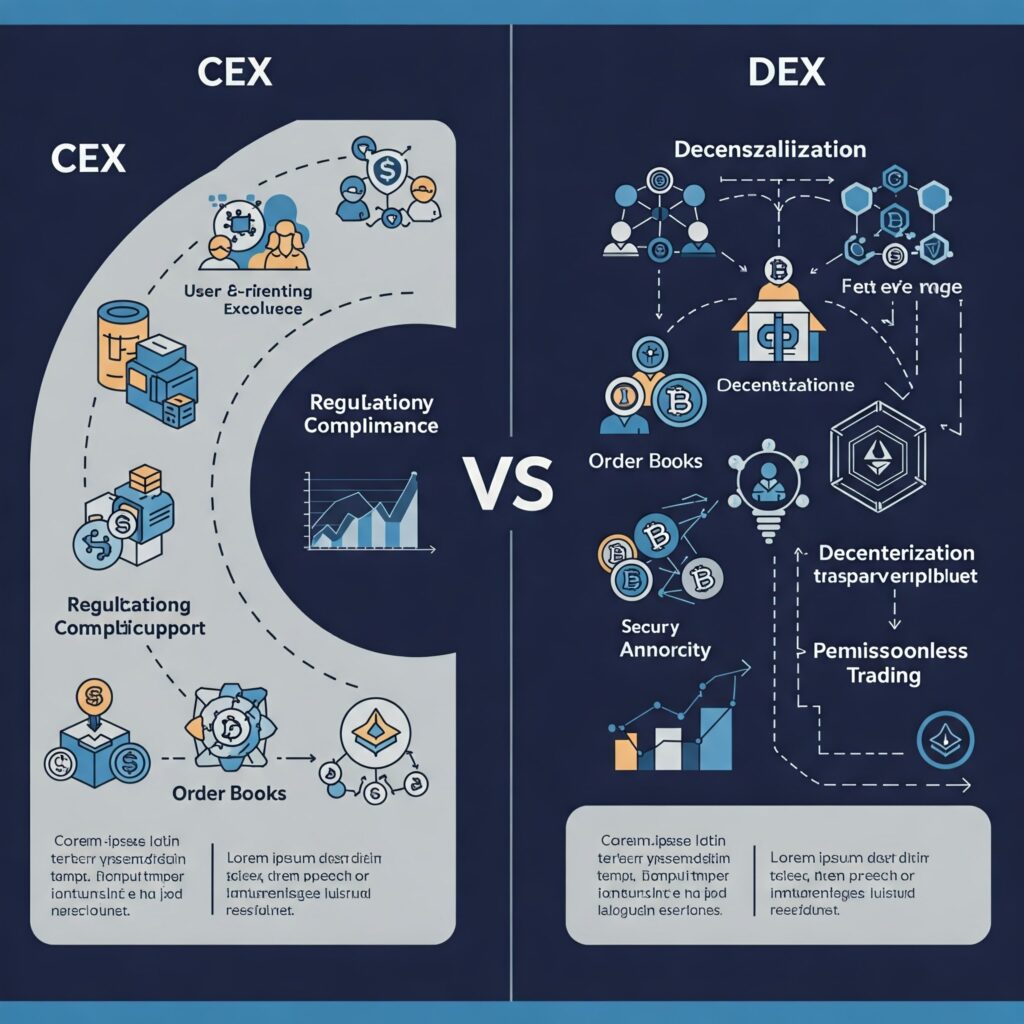

Centralized vs Decentralized Exchanges:

Cryptocurrencies consist of centralized exchanges (CEXs)and decentralized exchanges (DEXs). These two exchanges operate differently: where users may buy, sell, and trade digital assets. The differences are founded on the security and control concerning user experience.

In this article, we will discuss the key differences between centralized and decentralized exchanges, their pros and cons, along with which might be best suited for which type of trader.

1. Centralized Exchange (CEX).

A CEX is a trading platform for cryptocurrencies managed by a company or organization. These are platforms that allow buying and selling through intermediaries.

How Does CEX Work?

The users create an account and deposit funds.

The exchange holds and manages users’ funds.

Buyers and sellers trade through the exchange’s platform.

The exchange charges transaction fees.

Examples of Centralized Exchanges.

Binance.

https://www.binance.comBinance.com

Coinbase.

Kraken.

Bybit

![corporate-like digital exchange managing cryptocurrency trades centrally.]](https://affilipro.online/wp-content/uploads/2025/03/1741000498032-300x300.jpg)

2. What is a Decentralized Exchange (DEX)?

A decentralized exchange (DEX allows users to trade directly without the intervention of a third party. It uses blockchain and smart contracts to execute trades automatically.

How do DEXs operate?

Users connect their wallets, and no account needs to be set up.

The trades are done between users directly via smart contracts.

The exchange itself does not hold any funds for the users.

There is no single authority controlling the platform

Examples of decentralized exchanges

Uniswap

PancakeSwap

SushiSwap

dYdX

5. Merits and Demerits of CEX and DEX

✅ Advantages of Centralized Exchanges

✔️ These are quite user-friendly with an easy interface.

✔️ Provides liquidity so that trading becomes smooth.

✔️ Quick transactions.

✔️ Customer support service provided.

❌ Disadvantages of Centralized Exchanges

❌ Users do not have control over their private keys.

❌ There is an increased risk of hacks.

❌ Subjected to government regulations.

The advantages of Decentralized Exchanges

The users are in charge of their own funds.

No central authority, no censorship.

More privacy involved. No KYC required.

Less chance of being hacked because funds are not stored at the exchange.

Disadvantages of Decentralized Exchanges

Lower liquidity implies slower trades.

More complex for beginners.

No customer support.

5. Which One Should You Choose?

Choose a CEX if:

✅ You are a beginner looking for a more manageable interface.

✅ You want high liquidity and fast trades.

✅ You would rather have customer support at your beck and call.

Choose a DEX if:

✅ You appreciate privacy and total control over your funds.

✅ You want to stay away from government restrictions.

✅ You know enough about blockchain.

https://affilipro.online/2321-2/

6. Conclusion

Centralized and decentralized exchanges have both their own advantages and disadvantages. CEXs favor convenience and speed, while DEXs favor privacy and security. The preferred option ultimately depends on experience with trading, security needs, and liquidity considerations.

Are you hoping for the type of exchange that precisely fits your needs?