Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

In a major step to comply with the European Union’s Markets in Crypto-Assets (MiCA) rules, Binance Suspends USDT Spot Trading in Europewith Tether (USDT) for customers in the European Economic Area (EEA). The amendment will take effect on March 31, 2025, and emphasizes changing regulatory environment for cryptocurrency exchanges in Europe.

MiCA, which is effective as of December 30, 2024, establishes a broad regulatory framework for the regulation of crypto assets in member states of the EU. MiCA is designed to improve transparency, protect investors, and promote financial stability. To facilitate this purpose, MiCA requires stablecoin issuers to obtain a specific authorization to issue and operate in the EU. The authorization requirement ensures that only compliant stablecoins are traded within the EEA.

In preparation for the implementation of MiCA, Binance has indicated that it will stop spot trading pairs for non-compliant stablecoins, including USDT, DAI, and TUSD. These spot trading pairs will cease to be accessible for EEA users as of March 31, 2025. Nevertheless, the exchange continues to allow users to deposit and withdraw these stablecoins for perpetual trading, providing some concession while spot trading has ceased.

The halting of USDT trading in the spot market has led European traders and investors to re-evaluate their approaches. Binance has encouraged users to convert their USDT into MiCA-compliant stablecoins, such as USD Coin (USDC) or Euro Coin (EURI), or directly into euros (EUR) to avoid any risk of liquidation. The implications of this move affect the entire trading strategy of individual users as well as the overall stablecoin ecosystem in Europe.

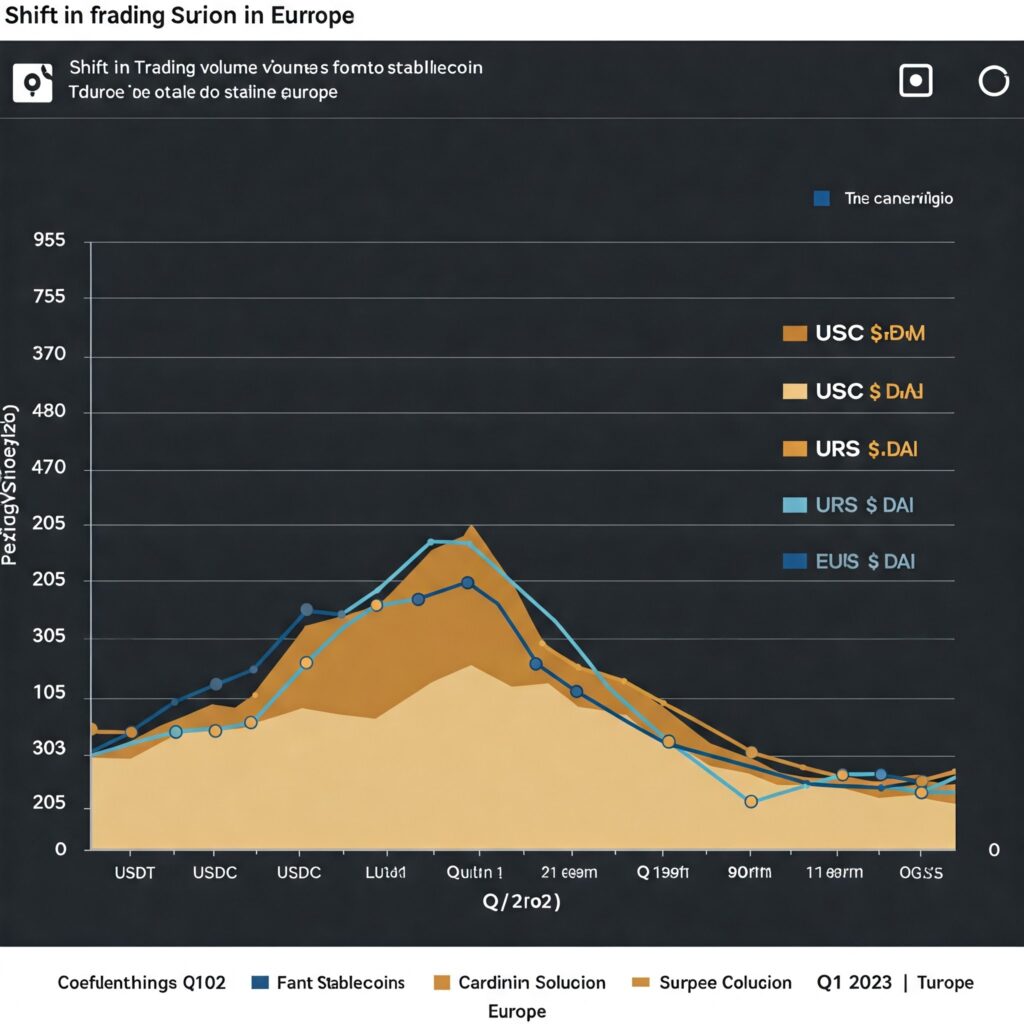

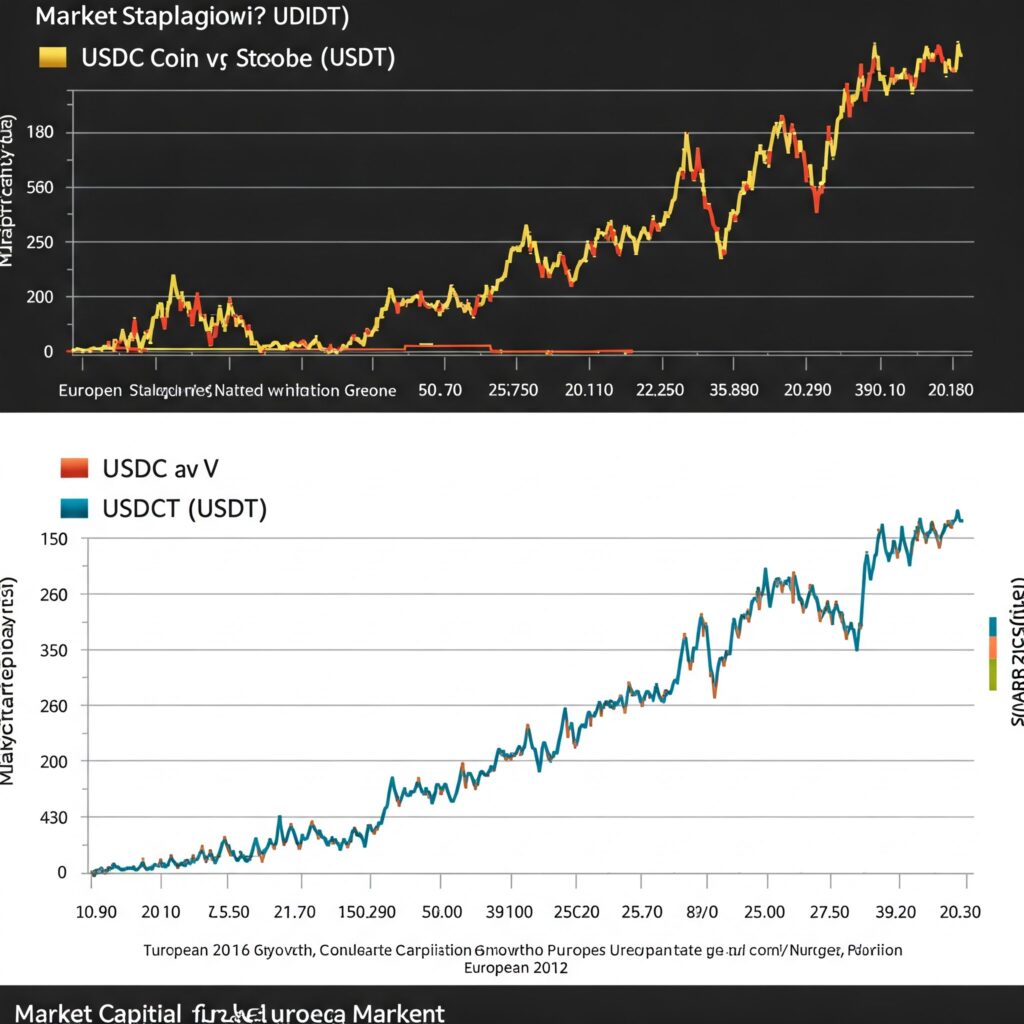

Since USDT is becoming less present in Europe’s market, USDC seems ready to take over more of the market share. During the year of 2024, USDC’s weekly transaction volume increased to $23 billion compared to $9 billion in 2023. The trend points to a shift in preference among users in Europe towards USDC, likely positioning it as the dominant European stablecoin in the future.

https://www.binance.comBinance

Binance isn’t alone in their compliance plans for MiCA. Exchanges like Kraken have also delisted USDT spot trading pairs in the EEA. Kraken limited USDT trading to a sell-only mode on March 24, 2025, preventing EEA users from buying the stablecoin. The coordinated actions across exchanges demonstrate the ripple effect of MiCA in the European cryptocurrency exchange landscape.

European crypto users have to adjust accordingly to this new regulatory framework by:

1. Changing Non-Compliant Assets: Shifting your holdings out of non-compliant stablecoins like USDT to MiCA compliant alternatives like USDC or EURI.

2. Staying Up To Date: Checking in often on exchanges’ announcements regarding compliance with exchange assets and whether the exchange is compliant.

3. Finding New Exchanges: Examining alternate exchanges that may still provide you access to certain stablecoins, but make sure the exchanges comply with regulations.

.The suspension by Binance of USDT trading in the spot market in Europe illustrates the increase in influence that MiCA will have on the market. While these regulations aim to provide greater investor protection and stability to the market, they also require traders and exchanges to follow new compliance rules.

For users in Europe, this change requires the trading of MiCA compliant stablecoins like USDC and EURI and trading or transitioning to trading directly in fiat. While USDT is still available for deposit and withdrawal, limited functionality in the EEA may force traders to consider trading in alternative assets.This may also be an increasing opportunity for regulated stablecoins to capture market share, especially with USDC increasingly being recognized as a compliant alternative.

As regulatory changes continue to develop, crypto users must adapt to the changes and stay informed. The crypto industry is entering a new phase of compliance with the opportunity for innovation will be balance.

The compliance framework will be important for both the insitutional and retail markets’ growth and stability in European crypto.

https://affilipro.online/tether-adds-8888-btc/