Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

• The recent sell-side liquidity sweep shows XRP’s bullish potential with new price levels.XRP’s Liquidity

• It will require support of $2.2220 to continue growing but $2.9990 and $3.4000 could pose resistance barriers.

• XRP’s price action will largely depend on proper funding management. If there is too much leverage then the market will continue to liquidate. XRP price action has received some attention recently due to a recent sell-side liquidity sweep which has implied a potential bullish shift.

The combined technical analysis data reflects a market structural change which usually indicates that the path of least resistance should be up. Traders are peaking at price action near $2.2220 since it also coincides with fundamental support and, equally important, the distinguished order block.

The daily time frame indicates a significant move in that the price swept over sell-side market liquidity. It appears the market makers have taken it upon themselves to liquidate their weakest positions during this price compression time of $2.10 to $2.20. The price action is consistent with the bullish structure reformation which would indicate that a major shift could happen in the underlying market dynamics from here.

Analysts identified an order block around the area of $2.2220 which could be a major zone of support. As long as XRP remains above that zone, it helps foster the idea of another breakout to higher targets. The main resistance zones to look out for on the chart is at $2.9990 and $3.4000 where traders might look to take profits based on price discovery to the upside after a breakout.

xrp https://coinmarketcap.com/currencies/bullish/

On the flip side, if the order block fails to hold then price action might go back to lower levels. A breakdown from $2.20 will invalidate the bullish thesis and allow for lower prices.A sustained buying momentum of XRP holding above the order block could propel the price action against its highs back towards $2.9990 then possibly set up the price action for $3.4000, if buyers are intense.

If the price fails to hold the important zone, it should increase selling which would move the price of XRP back into lower liquidity areas under $2.20.

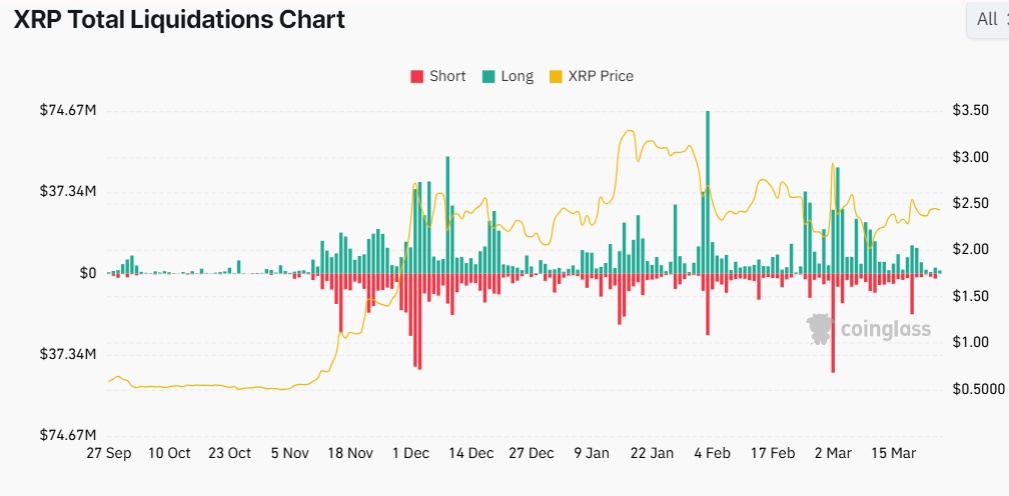

the XRP Total Liquidations Chart, the latter part of November exhibited a notable positive trend, surging into new highs that eventually exceeded $3.00 by early January, whereafter prices experienced a rapid decline but have since bounced back with a current trading range between $2.00 – $2.50.

Short liquidations reached their highest levels in late November and early December, while long liquidations similarly peaked in early February and early March coinciding with price declines.These liquidation patterns suggest the risks associated with excessive leverage, where significant market swings adjusted or eliminated both short- and long-trading positions. Market assessment suggests if XRP can maintain support inside the $2.00 to $2.50 range, there could be some target towards the $3.00 – $3.50 resistance range in the future.

The direction of movement for XRP will depend heavily on the liquidity mechanics of the asset; therefore, traders are even more cautious with their market assessments at this time.The post XRP’s Liquidity Sweep Signals Breakout: Can It Surpass $3.00? first appeared on Crypto Front News. Visit our website for more interesting content on cryptocurrency, blockchain technology, and digital assets.

The XRP market is experiencing notable liquidation events, particularly affecting long positions, which may indicate over-leverage among bullish traders. While short-term technical patterns suggest caution, long-term forecasts hinge on broader adoption and regulatory developments. Investors should remain vigilant, considering both technical indicators and fundamental factors when evaluating XRP’s market trajectory.For a more in-depth analysis of rising XRP liquidations and their implications, you may find the following video informative: